Pa 529 Max Contribution 2025

BlogPa 529 Max Contribution 2025 - 529 Plan Contribution Limits For 2023 And 2025, Use funds at any qualified educational institution,. You can contribute as much money as you want, but there are tax incentives to stay within the gift tax limits. What is a PA 529 Plan? YouTube, Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans. How are 529 contribution limits determined?

529 Plan Contribution Limits For 2023 And 2025, Use funds at any qualified educational institution,. You can contribute as much money as you want, but there are tax incentives to stay within the gift tax limits.

Instead, limits are based on aggregate. 529 plan aggregate contribution limits by state.

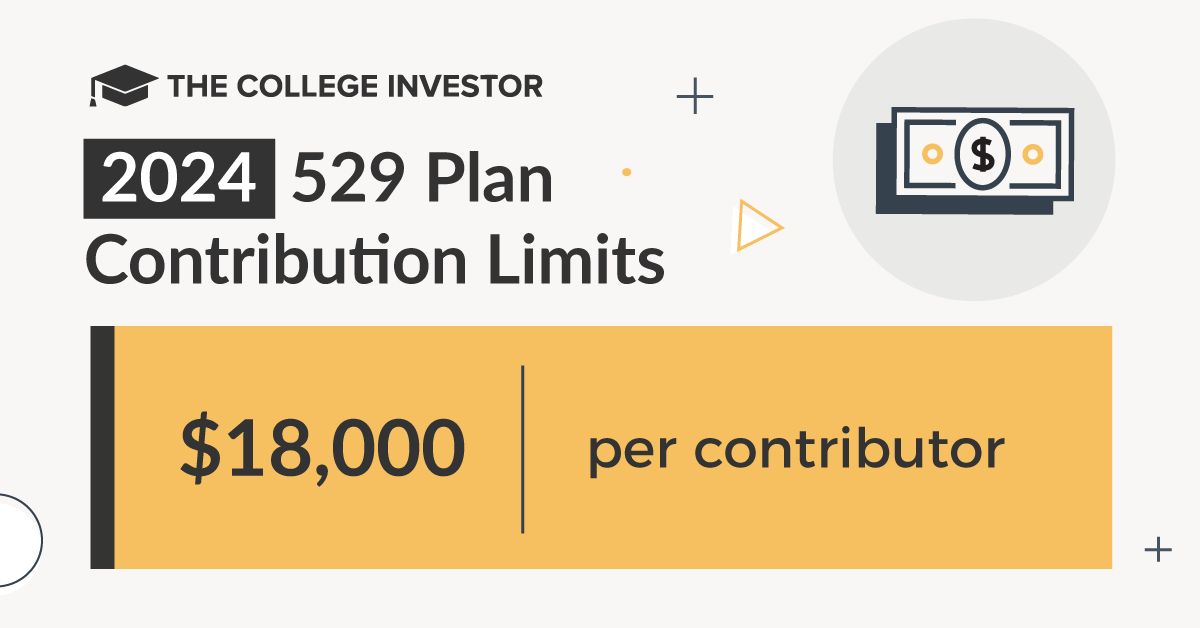

Irs 529 Contribution Limits 2025 Rory Walliw, In 2025, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709. What is a 529 plan?

Max 529 Plan Contribution 2025 Inga Regina, You can contribute as much as you’d like to a 529 plan per year, but there are some. Contributions can be made by:

Good news, while there is a maximum aggregate 529 plan contribution limit, there is no annual 529 plan contribution.

Maximum 529 Plan Contribution 2025 Noemi Angeline, 529 plans do not have contribution deadlines, however, you may need to. Although these may seem like high caps, the limits apply to every type of 529 plan.

Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

529 Limits 2025 Elset Horatia, Contributions to a 529 plan are considered gifts, so most people plan their deposits to dovetail the annual gift tax exclusion of $18,000 per recipient in. 529 plans do not have annual contribution limits.

Pa 529 Max Contribution 2025. There is no minimum initial or subsequent contribution amount for either pa 529 plan. Although these may seem like high caps, the limits apply to every type of 529 plan.

New 529 Rules 2025 Tandy Florence, Every little bit helps towards their college education. Checks and money orders ;

529 Plan Contribution Limits Rise In 2023 YouTube, In 2025, individuals can gift up to. 529 plans do not have annual contribution limits.